But, the silver lining is that through all these experiences, I was forced to learn more about accounting and bookkeeping. And now a much better handle and an idea of what needs to be done. I’m able to pick up on, if there is a mistake, or if something is happening.

But it also takes the stress off because we don’t enjoy this stuff. When you have good people around you, it takes the stress off of you as well. God has given certain people the amazing gift of being an accountant.

Best Accounting Software for Artists and Musicians in 2022

Many artists are their own DIY accountant, but some might be curious to see what options exist to bring in the professionals. As artists we have some unusual expenses that can be deducted as business expenses. The IRS states that businesses and individuals may deduct all “ordinary and necessary” items to run a business.Who or what defines “ordinary and necessary”?

- I think part of it is because it just seemed so stressful for me.

- They are labeled “To Do”, “Receipts and Statements”, “Address Updates”, and “To File”.

- Americans for the Arts serves, advances, and leads the network of organizations and individuals who cultivate, promote, sustain, and support the arts in America.

- Compare the five accounting programs in this article to find the right one for your artistic endeavors.

- Most of them make very little money, usually less than $200,000 of revenue per year.

- For freelancers that have made the leap into LLCs or S-corporations, Casey Moss Tax has you covered.

There are many good programs available that are user-friendly. You do not have to be a computer whiz or an accounting expert to use these programs. This program allows me to do receipts for my sales, track my expenses, print checks, and maintain information on my customers and vendors. Other easy, inexpensive programs include MONEY and Quicken. No matter what system you use, manual or computer, make sure you save all of your physical receipts of expenses and a copy of all your receipts of sales and other income.

Inciter Art

Americans for the Arts serves, advances, and leads the network of organizations and individuals who cultivate, promote, sustain, and support the arts in America. Founded in 1960, Americans for the Arts is the nation’s leading nonprofit organization for advancing the arts and arts education. This great free software program for bands or musicians just starting out is Bokio! For free, they offer almost the same services as the major suppliers.

It’s worth noting that they focus their services on creative agencies and production companies rather than individuals or nonprofits. Artists typically enjoy producing art more than they enjoy producing business records. However, artists who want to make money from their work should adopt good business practices to ensure a long-lasting income stream. Bookkeeping is the backbone of good business practices.

What Is The Best Accounting Software For Artists?

For example, the NY Council of Nonprofits offers financial services to its members including help with budgeting, accounting systems analysis, audit prep, and more. The North Carolina Center for Nonprofits works with the NC Association of CPAs to offer pro bono services to its members. But it can be especially overwhelming for artists who are also managing the creative aspects of their work, multiple day jobs, and the financial precarity of a creative life.

You’ll basically be going into debt every time you’re selling something. The other thing is, what products can you create that would then be more profitable? So get your wheels turning and start coming up with ideas. What kind of products can you create that will be profitable?

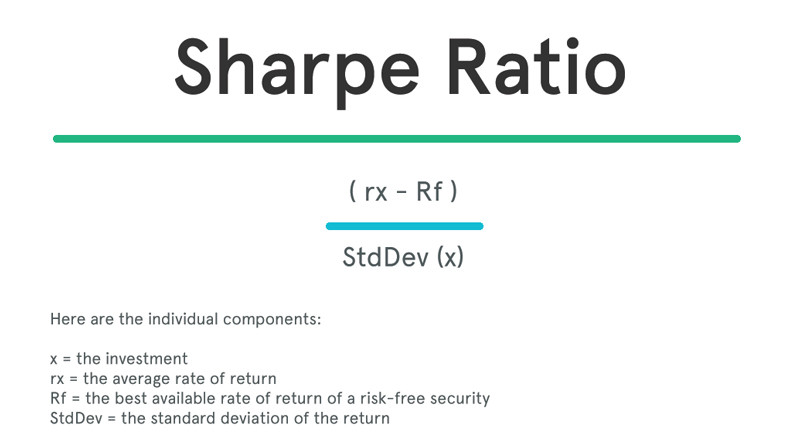

It can really help you make decisions on what products to sell in your shop. I have an Etsy profit calculator for you in my Etsy Shop Makeover Course. In that calculator, you can put all of your products. You just enter a few numbers, and then it will tell you your percent of the profit from every product.

National Council of Nonprofits

For instance, if you are an artist who creates many instructions as part of the design process, you may need to use a program that automatically generates those instructions. Fiscal Sponsorship for artistic entities originally cropped up as a way for artistic entities Accounting for artists to seamlessly transition into 501(c)3 incorporation. Artists now consider Fiscal Sponsorship to be a viable and sustainable business model on its own. It is a great way to take advantage of opportunities usually only available to nonprofit organizations.

On top of that, the technology extensively automates accounting processes for the benefit of artists and musicians. Artists often engage on many projects at once, each of which has a separate deadline. They are able to maintain tabs on their revenue and expenses, too.

The authors unravel and navigate the paradoxical “in-between” of art, accounting and technology. The purpose of this paper is to provide a critical reflection on how ongoing revolutionary technological changes can extend the possibilities of accounting into artistic spaces. In addition, arts ability to protest, challenge, open and inspire may be instrumental to humanise technological advances transforming the accounting profession.

When you’re more organized when you are really paying attention to the numbers and the accounting. It actually brings a lot more peace that allows you to sleep better. As more and more streams of our business began happening.

Account Junction can serve as your one-stop shop for bookkeeping and tax preparation. You must manage your budget, create and sign contracts with studio spaces or freelancers, save money, then make it all legible to the IRS come tax season. Nobody becomes an artist because they secretly want to be their own accountant. However, if you begin your creative profession, you will undoubtedly have to deal with your own finances.

- I’ve always found it easy to use because all the features are intuitive.

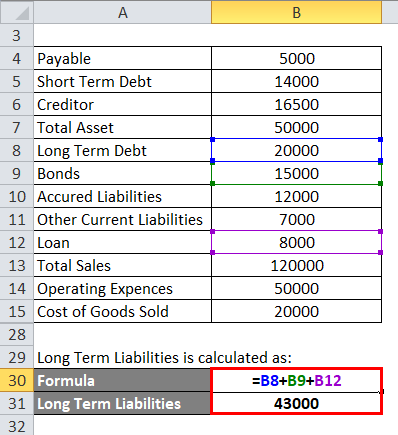

- You can purchase an accounting software program without spending a fortune.

- QuickBooks Self-Employed costs $15 monthly, or you can bundle your accounting software with TurboTax for $25 monthly.

- You can still keep all the paper in a shoebox, but at least it will be organized in the ledger book.

My advice to you is – if you are in doubt as to whether your expense is deductible, keep the receipt and consult your tax preparer. Your deductions should be related to your art and the business of producing your art for sale. Marketing your firm’s accounting services to an artist may feel like an up-hill challenge, but a challenge, non the less, that can be conquered. By helping artists perceive the connection between their art and financial planning to help them be successful, is the key. By helping artists perceive the connection between their art and financial planning to help them be …

Using a simple spreadsheet will allow you to keep your business information in a format that will be easy for you or your accountant at tax time. For example, using Microsoft EXCEL you can use one workbook with a tab for income and a tab for expenses. You can purchase an accounting software program without spending a fortune.