The best charting software will allow you to create visually appealing charts easily. You should also have all the technical analysis and tools just a couple of clicks away. For traders new to investing, TradingView is one of the best places to view many different charts alongside indicators. The platform allows access to various indicators, assets, time frames, and even has a demo account. Charts can be used in different ways to test investment strategies.

So, if a candlestick chart for one month with each candle representing a day has more consecutive reds, then traders know that the price is falling. As you can see from the image below, candlestick charts offer a distinct advantage over bar charts. Bar charts are not as visual as candle charts and nor are the candle formations or price patterns.

Engulfing Candlestick Patterns

As you study this chart, pay close attention to the volume and how it corresponds with each candle. This pattern works particular well at the high of the day as a trend reversal. But it can also be a trend continuation pattern if it appears at the top of a short-lived rally into prior resistance. In the example below, you’ll see that the general trend is downward. For this reason, the bullish engulfing sandwich can be thought of as a continuation pattern. Just like the example above, the 5-minute candle completely engulfs the prior candle.

- And, when occurring within a pronounced trend, it may be viewed as a continuation pattern.

- The rectangular real body, or just body, is colored with a dark color (red or black) for a drop in price and a light color (green or white) for a price increase.

- Traders must remember that while an individual candle provides sufficient information, patterns can be determined only by comparing one candle with its preceding and next candles.

- This means in high-volume periods, a tick chart will show you more crucial information than many other variations.

- This material does not consider your investment objectives, financial situation or needs and is not intended as recommendations appropriate for you.

Whenever making trading decisions based on technical analysis, it’s usually a good idea to look for confirming indications from multiple sources. The bullish engulfing pattern appears during bearish https://g-markets.net/ trends. It consists of a bearish candle followed by a bullish candle that engulfs the first candle. Candles are constructed from four prices, specifically the open, high, low and close.

How do you read a candle pattern?

By viewing a series of stock price actions over a period of time (intraday), you’ll be in a better position to predict how they’re going to behave in future. These candlestick patterns could be used for intraday trading with forex, stocks, cryptocurrencies and any number of other assets. But using candlestick patterns for trading interpretations requires experience, so practice on a demo account before you put real money on the line. It is formed of a long red body, followed by three small green bodies, and another red body – the green candles are all contained within the range of the bearish bodies. It shows traders that the bulls do not have enough strength to reverse the trend. If a candlestick pattern doesn’t indicate a change in market direction, it is what is known as a continuation pattern.

- For example, with a bullish engulfing, it makes sense to set a buy-stop above the upper shadow and a sell-stop at the lower shadow.

- Here are a few most frequently asked questions regarding the inside day candle.

- The only difference being that the upper wick is long, while the lower wick is short.

They form different shapes and combinations commonly known as candlestick or candle patterns. Candle patterns can be single, double or triple patterns that consist of one, two or three candles respectively. As an asset’s price is plotted over time using Japanese candlesticks, they form a Japanese candlestick chart of many candlesticks. The graph you see below is a 4-hour candlestick chart where each of the candlesticks represents a 4-hour period.

The Evening Star

There are, indeed, many alternatives to candlestick charts like line charts, point and figure charts, and bar charts. Both bar charts and candlestick charts provide the same information regarding the price movement of stocks, just in different ways. Candlestick chart analysis depends on your preferred trading strategy and time-frame. Some strategies attempt to take advantage of candle formations while others attempt to recognize price patterns.

As you see, there are so many candlestick patterns that you can use in the market. In this article, we will look at just one and see how to use it when doing analysis. However, for candlestick patterns, you can only use the manual approach to backtesting.

Explore the markets with our free course

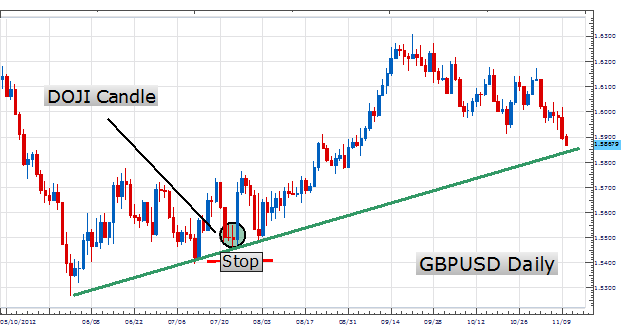

The “doji’s pattern conveys a struggle between buyers and sellers that results in no net gain for either side,” as noted in this great article by IG.com. Just as the high represents the power of the bulls, the low represents the power of the bears. The lowest price in the candle is the limit of how strong the bears were during that session. By default, most platforms will show a red or black candle as bearish.

Tech View: Nifty forms Doji candle ahead of weekly expiry. What traders should do on Thursday – The Economic Times

Tech View: Nifty forms Doji candle ahead of weekly expiry. What traders should do on Thursday.

Posted: Wed, 23 Aug 2023 07:00:00 GMT [source]

If there is no upper wick/shadow it means that the open price or the close price was the highest price traded. The open price depicts the first price traded during the formation of the new candle. If the price starts to trend upwards the candle will turn green/blue (colors vary depending on chart settings). And, when occurring within a pronounced trend, it may be viewed as a continuation pattern. Traders attempt to join the breakout direction via buying above the inside day’s high or selling beneath the low.

But understanding Renko from Heikin Ashi and judging the best intervals from intraday scalping to 5-minutes and 1-hour can be challenging. This guide breaks down the best trading charts in 2023, including bar, candlestick, and line versions. Finally, we share tips on where to get the best free and paid-for charting software. This tells you the last frantic buyers have entered trading just as those that have turned a profit have off-loaded their positions.

Hanging man candles are most effective at the peak of parabolic like price spikes composed of four or more consecutive green candles. Most bearish reversal candles will form on shooting stars and doji candlesticks. So, how do you start day trading with short-term price patterns?

So without wasting your time, let us jump to the first section i.e. introduction to Candlestick Patterns. The best charting software largely comes down to your personal preferences. Key features to look for include a wide range of indicator tools, real-time data, and an intuitive design that’s easy for you to navigate. Dragonfly Doji – This type of candlestick forms when open, high, and close price is the same, and the low prices forms a long lower shadow. Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security.

The Hammer / Hanging Man

The second try gave us a beautiful confirmation with the Dark Cloud Cover pattern. As you can see from the chart, often times vwap can be a great target area (red candle day trading line). The tweezer top is yet another reversal pattern or continuation pattern. This gives the attentive trader an opportunity to capitalize by going short.